Pre-mine > ICO > STO > DAICO > airdrop > and now: Airgrab ?? - What's going on here?

Pre-mine > ICO > STO > DAICO > airdrop > and now: Airgrab ?? - What's going on here?

Date: 21 Nov 2018

Crypto OG’s started off with pre-mines and reddit giveaways as a way to get their project’s coinz into peoples’ hands. Ethereum then brought massive attention to the ICO as a way to get tokens distributed. As regulators increasingly scrutinize the ICO model for securities law applicability (e.g. recent SEC case against EtherDelta), some projects have chosen the airdrop model instead. Questions remain (and probably will be argued over for years yet….) as to whether airdrops sufficiently ‘skirt’ securities laws.

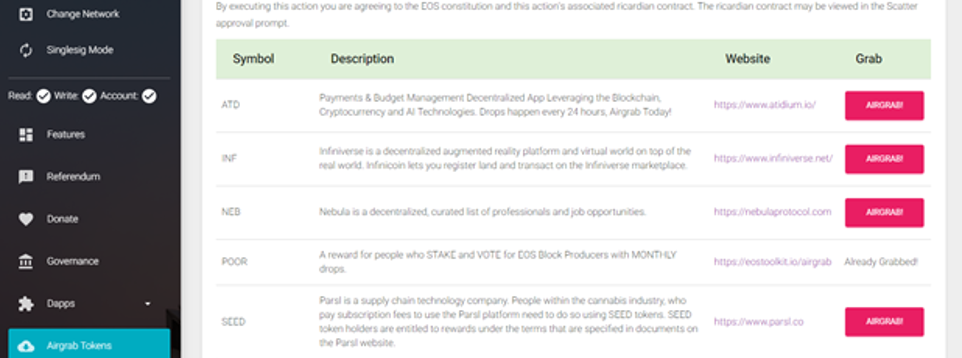

Things are moving on: the ‘airgrab’ is a new variant. For instance: fire up your EOS toolkit client, peruse airgrab contracts available to your EOS address/account, do a transaction to ‘turn on’ or ‘link up’ your airgrab coinz and voila!…you just received HireVibes, TRYBE, SEED or EOSclassic airgrab tokens.

Whilst endless amounts of angst are spent determining if STO’s, ICO’s, DAICO’s (ICO+DAO) or even SAFT’s can be constructed in ways that avoid or minimise the risk of being studied by regulatory bodies for securities law transgression (is it a security token or is it a utility token? is there an ‘offer and sale’ taking place? did the org that issued the coin/token derive valuable benefits from the issuance?), some projects are using airgrab instead as a way (maybe?) to avoid possible legal troubles from the start. Essentially, the designers of airgrabs are ‘giving’ you their air-grabbable coinz ‘for free’ without expecting services in return, so no security (share issuance) is involved – arguably. Well, that’s perhaps the theory.

In token economics terms, the airgrab is an interesting beast: the designers of the airgrab token/coin hope to generate value/funds for themselves through reserving a portion of the coinbase whilst getting users to generate a market value for the coin/token through secondary market trading of the airgrabbed allotments.

This may seem like ‘ICO redux’ and arguably has yet to attract regulatory test via the courts. Or maybe it never will: that’s perhaps the bet here. Sooner or later, it seems inevitable that some project team in crypto space will stumble upon, dream up or arrive at the perfect model that achieves the goal of widespread distribution without giving Johnny Law a way to bring the dream back down to earth. Who needs an IPO and the SEC then?

Crypto OG’s may argue that the whole of crypto was/is based on the notion that you and I can decide that we prefer the Bitcoin codebase to the USD fiat dollar….so maybe we can also decide for ourselves that an airgrab token is after all better for us than some SEC-approved IPO share.

Curious for more re EOS Airgrabs - There are numerous excellent resources on a google search for Airgrab tokens.

We are working with a number of projects that are implanting this method. IF you are keen to work in the crypto space see our live vacancies here.

Back to News Share to LinkedIn

Share to LinkedIn Share to Twitter

Share to Twitter Share to Facebook

Share to Facebook Back to news

Back to news