What is cryptocurrency? (Part 3: Replacing modern cash)

What is cryptocurrency? (Part 3: Replacing modern cash)

Date: 19 Nov 2017

What is cryptocurrency? (Part 3: Replacing modern cash)

Money by definition is an arbitrary medium for store of value. In ancient times, people used what was considered rare in order to exchange as money; precious metals, cowry in landlocked countries or Central areas, precious stones, pearls, and many other things. In more modern times we have standardized forms of exchange in the form of a coins or banknotes approved by a central Authority, however as mentioned in Part 1, in times of failure of the economy people do revert to more primitive forms of money such as cigarettes in the Weimar Republic.

All money is a matter of belief.

— Adam Smith

All money serves some basic functions; just to quickly recap, they are:

Money must be a store of value. If the ‘value’ of money changes drastically from one day to the next, as explained previously in the Weimar Republic example, people will stop using it and turn to other types of stores of value.

Money must be usable as a unit of account. You need to be able to relate the “value” of money to the value of something else, say 10 cowry shells for a bowl of noodles or one gold ingot for a horse.

Money must be usable as a medium of exchange. You cannot be the only one trading in cowry shells, everyone else must be ready to accept them as a means of payment. If you go from the landlocked areas where cowry shells are rare to the seaside towns where cowry shells are plentiful, it may not be recognised; the same as when you travel to a different country today.

Today almost every nation in the world has its own form of fiat currency backed by no assets and issued by the government valued at its ability to serve as tax credit. When we look back that’s actually not much difference between cowrie shells and fiat currency both of them arbitrary means of store of value. When you think about it, there is as much value and utility in a piece of paper as there is in a cowry shell, but we recognise them not for their intrinsic value but rather their exchange value. Additionally, cowry shells and bank notes share some similiar characteristics that enable their common use as money: durability, portability, divisibility, uniformity, limited supply (or rarity) and acceptability.

The United States can pay any debt it has because we can always print money to do that. So there is zero probability of default.

— Alan Greenspan, Chairman of the Federal Reserve, 1987–2006

If they look familiar, it’s because they were discussed in Part 1 and I think the reasons for these charactertistics should be more or less self explanatory, but if you would like more explanation this podcast by the Federal Reserve Bank of Saint Louis goes into more detail about why these characteristics are important for a medium to be usable as money.

So how about crypto? How well does cryptocurrency work as money? I wouldn’t just say that it works well, I’d say that cryptocurrencies are even better than what we are using today as money (government issues fiat and bank issued credit). Let’s take a look at each characteristic in the context of crypto:

Durability: Crypto isn’t even physical! It’s inifinitely durable compared to a physical product. But wait, isn’t it just data? Can’t it be destroyed like hard disks and thumbdrives? Technically it could, but remember in Part 2, as we discussed the blockchain which record every individual fraction of crypto (down to 18 decimal places in some cases), is distributed across nodes. You can’t destroy 1 node to wipe that record, you’d need to destroy all of them.

Portability: Due to it’s electronic nature, crypto is stored “in the cloud” similar to dollars in your bank account. All you need to pay in crypto is a phone application and wifi or a modile data connection to send requests to the blockchain.

Divisibility: While you can break dollars into cents and think that’s very divisible, as mentioned above, crypto goes up to 18 decimal places. Not only that, every time you break a dollar into cents, you actually decrease the portability of money on your person as weight and space goes up but value of money goes down. This creates another interesting issue faced by some countries in relation to coins; in some cases of inflation, they find criminal or citizens debasing their currency and melting it down due to the metal value of the coins being higher than their exchange value! Fortunately, we will never have this issue with non-physical cryptocurrencies and be able to divide as much as we choose.

Uniformity: Each unit of cryptocurrency is indistinguishable from the next. While even some notes have serial numbers to indicates authenticity or minting order, if you transfer 1 Bitcoin to a wallet with 9 bitcoins, even the owner is not able to you which of the Bitcoins he received; they are perfectly indentical and fungible.

Acceptability: Probably the only aspect the crypto currently loses out to fiat from is in its acceptability as a medium of exchange. However, the situation is quickly changing and the more cryptocurrencies get exposure, the greater the rate of public adoption of crypto as payments and transactions.

Limited supply (or rarity): As covered in Part 1, governments will print money endlessly in order to fund public spending as taxation is usually insufficient in itself. Cryptocurrencies like Bitcoin however, have a hard limit as determined by software: no one can ever create more Bitcoin and even if they performed a hardfork to do so, they would likely be the only ones who accepted the “new” currency created.

When it comes to pure utility as money, it seems that crypto is unmatched as long as it is accepted. So why is it not accepted at more vendors / merchants / service providers and why do more people not use it since it is so much better?

The answer is simple: Price.

Revolutions are something you see only in retrospect.

— Alan Greenspan, Chairman of the Federal Reserve, 1987–2006

A common complaint you may have heard regarding Bitcoin or cryptocurrencies in general is that they are “too volatile” and thus are not really usable as money. Indeed, it is a valid concern if your 2 Bitcoins could be worth a dollar right now and only 10 cents the next minute. The truth is that such large volatility in value actually happens for fiat currencies as well! The only reason we don’t think of fiat as highly volatile is because we are not exposed to its volatility on a regular basis and it is in many governments interests to prevent too much price volatility.

If you recall in Part 1, it was discussed that fiat gets its price or exchange value from supply and demand of said currency in the forex market. The truth is that fiat currencies are valued against each other, and against commodities. The most painfully obvious time we experience fiat currency volatility is when we are overseas on holiday and find exchange rates at money changers differing from one day to the next! Sometimes by as much as 10 to 20 percent! Some people, based on their geographic locations, may also experience fiat price volatility firsthand. I come from a small island nation state known as Singapore, where we do not have the land mass to perform farming that would be self-sufficient, hence we import almost all our produce and groceries from overseas. For nations like mine, price fluctuations in forex are felt almost immediately as the price of almost all day to day products go up if our currency weakens! Many nations with large lass mass that enable them to have an agriculture industry will never experience this, as they are able to buy produce with local currency and may never ever need to import certain goods.

Corn is a necessary, silver is only a superfluity.

— Adam Smith

If that is insufficient evidence for the volatility of fiat currencies, take into consideration the Asian Financial Crisis and the European Sovereign Debt Crisis, both while not a direct result of fiat volatility, could not have occured if the individual currencies of nations or states did not fluctuate.

So, is Bitcoin really more volatile than fiat? Could you really use this as “money” if its value changes from second to second?

The current problem with cryptocurrency is that it is not widely accepted as a form of exchange today, causing a need to perform an exchange to fiat in order to obtain liquidity. This creates a situation where the price of crypto is defined, not relative to the value of the goods and services it can be exchanged for (as there are few merchants who accept them currently), but relative to its value in fiat or other cryptocurrencies it can be traded for. In such a situation, it becomes extremely volatile as there is no longer an asset to which it is possible to “peg” its value against, but rather against other volatile currencies. The end result is that the price volatility in crypto is amplified by the volatility of all the currencies it can be traded against. Crypto is not more volatile than fiat, crypto gets its volatility from fiat.

What is the solution to this problem of crypto volatility in this case? It’s simple: the increased adoption of cryptocurrencies as a form of money by more and more merchants. While many purists aim to entirely eradicate fiat, this has faced many roadblocks in the form of regulations and oversight by the same authorities who have control over fiat (not always bad as will be discussed later). However, crypto does not need to replace fiat, as long as it is recognised more widely and can be used in coinjunction with fiat to purchase goods and services, the price volatility of crypto will start to even out.

I want to make sure you keep your eyes on the ball, that is, the two basic missions of a central bank. The first is maintaining macroeconomic stability: maintaining stable growth and keeping inflation low and stable… to create a more stable macroeconomic environment.

The second part of a central bank’s mission is maintaining financial stability. Central banks are focused on trying to ensure that the financial system functions properly, and in particular, they want to prevent, if possible, and if not, to mitigate the effects of a financial crisis or a financial panic.

— Ben Bernanke, Chairman of the Federal Reserve, 2006–2014

Another key factor that creates the impression of greater crypto volatility comes from the fact that there is no central authority governing the price of cryptocurrencies. With fiat, central banks are able to control the prices of their currency to a certain extent, through various mechanisms, by affecting both the demand and the supply. To keep it short, central banks can choose to control demand and supply by affecting interest rates, issue of treasury notes or simply by buying up excess currency in the forex market.

Why would they want to do this? Because that is the entire purpose of a central bank; to reduce uncertainty in the market. In crypto however, we have no central bank to provide a “cushioning” effect in the case of sharp spikes up or down the price charts. To make matters worse, cryptocurrency trading literally happens 24/7. There are no brokers to close on weekends that can close the doors on retail investors. With trading enable 24/7, you could imagine that it becomes a lot more volatile.

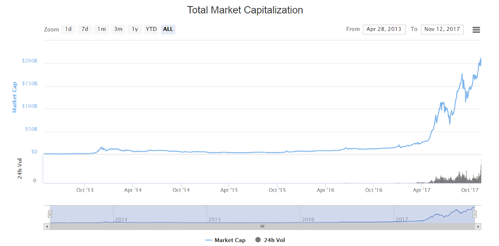

Screenshot of Coinmarketcap.com showing total Market Capitalization of crypto

The above picture shows the market capitalization or amount of fiat money in crypto over time. The immediately noticeable trend is that market capitalization has started to increased at an linear rate since April 2017. What this means is that more and more people are starting to be exposed and learn about cryptocurrencies and are beginning to either invest in them directly, or are starting to accept them as forms of payment for their goods and services. If this trend continues (as it is, it shows no signs of slowing down), the adoption rate of cryptocurrencies should continue on an upwards trend. Which in turns mean that volatility should decrease over time as more people are willing to accept them as “money”.

An important point to note regarding the price “volatility” of crypto. Even though cryptocurrencies have seen their share of ups and downs, the only “asset” that have appreciated more than gold since 2014 till now, is Bitcoin. Make what of it you will, but it does appear that for the foresseable future, cryptocurrencies are here to stay.

What’s the takeaway from this series of articles about crypto? Well, hopefully first and foremost, I hope I’ve addressed any fears you’ve had about crypto perhaps from hearing various statements from banking or finance industry leaders. Secondly, I hope I’ve given you some insight to the value proposition of cryptocurrencies over traditional fiat. And lastly, I hope that you now have a basic understanding of the technology behind it and why it is built on real innovation and not a scam or a pyramid scheme. Personally, I won’t advice you to put your life savings into crypto as the adoption rate today is not very high and volatility is truly a concern, but it could be a good long term investment.

If there are any questions you might have, you can reach Bryan at https://t.me/dashrandom or on Linkedin here - https://www.linkedin.com/in/bryan-chia-368818129.

All the best in your journey in this new and emerging field. I will be posting more articles on specifics of the cryptocurrency industry in the future, so keep an eye out!

And of course you are interested to work in this exciting emerging field CLICK HERE to see the available vacancies.

Back to News Share to LinkedIn

Share to LinkedIn Share to Twitter

Share to Twitter Share to Facebook

Share to Facebook Back to news

Back to news